Quite a few banks within the Philippines not too long ago promoted their financing packages for Tesla clients within the nation. Whereas the financing packages would probably entice a great variety of clients to the electrical automobile maker, the rates of interest for Mannequin 3 and Mannequin Y loans within the Philippines are extraordinarily excessive.

Tesla made waves within the Philippines after it opened its flagship retailer in Taguig, Manila. The electrical automobile maker additionally incited various conversations amongst native automotive lovers when it requested that its flagship retailer not be referred to as a dealership. For now, orders for the Mannequin 3 and Mannequin Y have been opened within the Philippines, with deliveries for the automobile anticipated in early 2025.

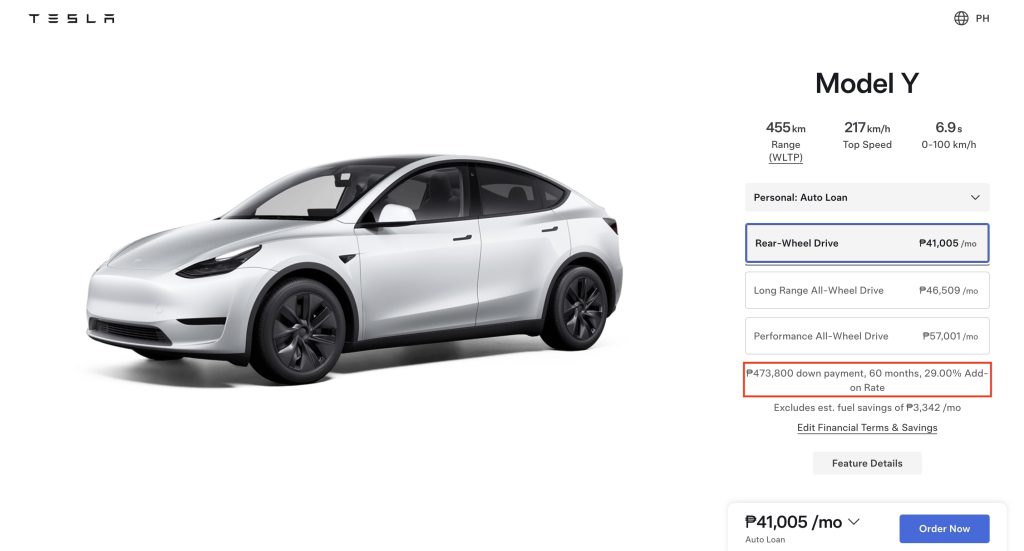

A take a look at Tesla Philippines’ order pages for the Mannequin 3 and Mannequin Y exhibits that financing offers are at the moment supplied by two Philippine-based banks, UnionBank and RCBC. In a latest announcement, UnionBank famous that it might supply a sooner approval course of for Tesla clients within the nation who want to buy their all-electric automobiles via a financial institution mortgage. RCBC, however, introduced a absolutely digital auto mortgage course of designed for Tesla clients within the nation.

“As one in every of Tesla’s most well-liked monetary suppliers within the Philippines, UnionBank is making it simpler for extra Filipinos to unlock the way forward for electrical driving… With aggressive rates of interest and a streamlined software course of, UnionBank is devoted to offering a seamless expertise for these trying to make the transfer to electrical driving,” UnionBank famous in an announcement.

Whereas these initiatives from UnionBank and RCBC will probably make Teslas extra enticing for Filipino drivers, the excessive rates of interest concerned within the precise loans for the Mannequin 3 and Mannequin Y might successfully end result within the two mainstream all-electric automobiles solely being attainable to higher-tier clients. It’s because, as per Tesla Philippines’ official web site, a 60-month mortgage for a Mannequin 3 or Mannequin Y with a 20% downpayment includes a whopping Add-on charge of 29%.

Sadly, extraordinarily excessive rates of interest for auto loans will not be unusually excessive within the Philippines. This is likely one of the explanation why some mainstream automobiles such because the Toyota Camry and even the Corolla are perceived as premium automobiles by some native shoppers. Hopefully, Tesla Philippines might ultimately give you a approach to supply the Mannequin 3 and Mannequin Y with a decrease APR. If Tesla Philippines might accomplish this, it might successfully end in a mainstream EV revolution within the nation.

Don’t hesitate to contact us with information suggestions. Simply ship a message to [email protected] to present us a heads up.